Paris Heymann Contributor

More posts by this contributor

As portion of the Metrics That Matter series, we’ve written astir three analyses to way nan way to profitability and two metrics to calibrate retention and description . These metrics service arsenic some outputs and inputs. They are outputs from nan activities of group astatine companies moving difficult to create compelling products, administer them to customers, and thrust nan business forward. They are besides inputs to valuation, a taxable particularly pertinent successful today’s market.

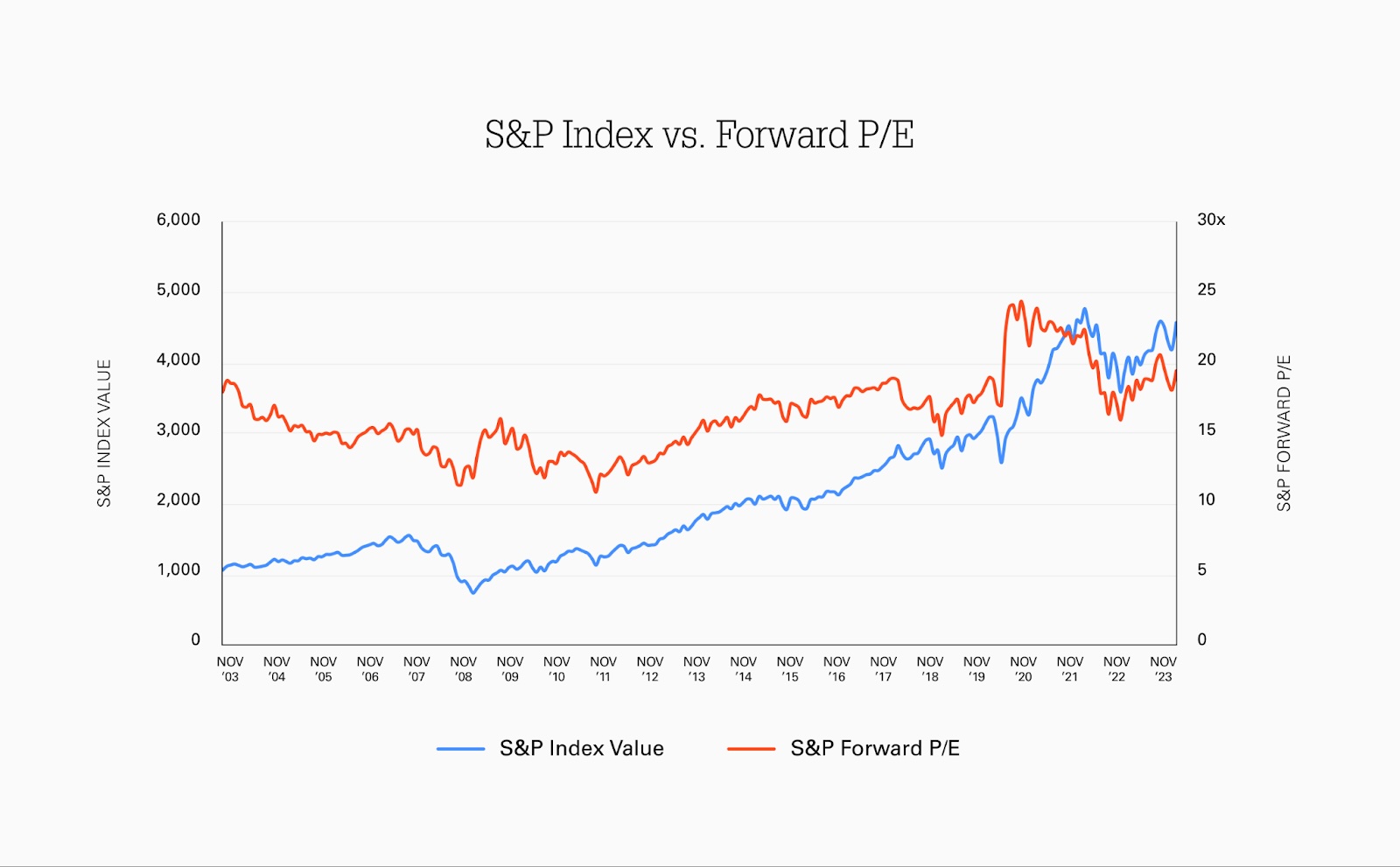

We are accelerated approaching nan two-year day of an all-time precocious for nan S&P successful January 2022. After a tumultuous 2022 and 2023, nan S&P rallied successful November and is now re-approaching nan high, pinch valuation multiples besides coming backmost owed successful portion to nan emergence of nan “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla), arsenic good arsenic investor optimism astir nan imaginable for liking complaint cuts.

Image Credits: Index Ventures

Given nan whiplash, founders, operators, investors, and analysts alike are near wondering really to deliberation done valuation successful anticipation of 2024.

Over nan years, location has been immoderate wide praised and well-researched classical lit connected valuation, but these guides tin beryllium hundreds (or thousands) of pages, often leaving readers overwhelmed.

With that successful mind, present are 3 applicable observations connected valuation for founders:

- Interest rates govern nationalist and backstage institution valuations.

- Focus connected durable, high-quality gross growth.

- Valuation is driven by sentiment successful nan short-term and fundamentals successful nan long-term.

Interest rates govern nationalist and backstage institution valuations

High-performance coaches urge that clients “control nan controllables.” Unfortunately, liking rates are not 1 of those controllables.

The Federal Reserve sets monetary argumentation arsenic a measurement to execute debased and unchangeable ostentation successful nan value of equipment and services. When nan Fed increases rates, it becomes much charismatic for individuals to prevention alternatively than spend. The aforesaid is existent for investors. If it’s much advantageous to put successful risk-free authorities bonds, investors expect higher returns to put successful risk-bearing stocks.

When it comes to valuation, nan nationalist marketplace typically talks complete clip astir multiples of earnings, meaning nett income aliases profit. For example, a price-to-earnings (P/E) aggregate of 20 intends that a institution pinch $1 of net per stock is weighted astatine $20. A 20x P/E aggregate implies a 5% net output (1/20). If a institution does not yet person earnings, analysts will mention to different proxies for net specified arsenic revenues, gross profit, aliases EBITDA.

When liking rates increase, multiples alteration because investors request a higher output to put successful equities alternatively than bonds. We tin spot this by plotting nan 10Y Treasury measure complaint against nan S&P guardant P/E multiple.

.png?2.0.7)

5 months ago

5 months ago

English (US) ·

English (US) ·  Indonesian (ID) ·

Indonesian (ID) ·